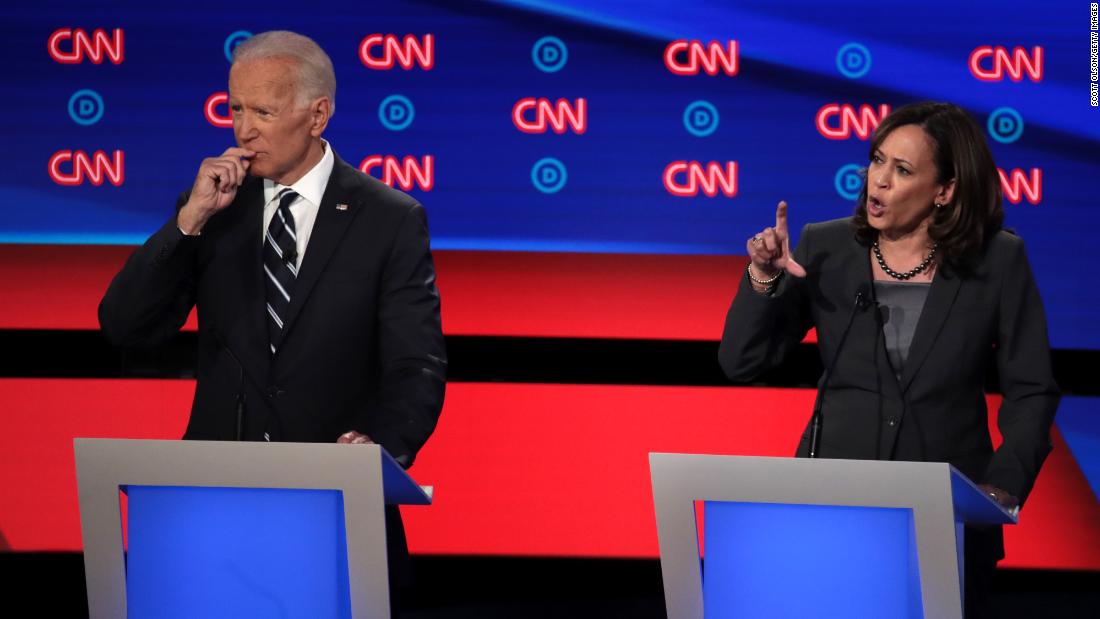

Biden sought to undercut the national health insurance plan that Harris released on Monday, saying the middle class would have to pay for it.

"It will require middle-class taxes to go up, not down," said Biden, who last week called the idea of being able to implement universal coverage without a middle-class tax hike a "fantasy world."

Harris says she will shield the middle class from any tax hikes by subjecting only higher earners -- and Wall Street trades -- to new taxes.

These provisions are one way Harris has sought to differentiate herself from her opponents, chiefly Bernie Sanders. Like the senator from Vermont, Harris wants to establish a national health insurance plan, but she would also retain a role for private insurance.

There's no single definition for the middle class. About 17% of tax returns in 2017 had adjusted gross incomes above $100,000, according to the Internal Revenue Service.

Harris' proposal calls for levying income-based premiums on households making more than $100,000, with an even higher income threshold for families living in high-cost areas.

Also, she would tax Wall Street stock trades at 0.2%, bond trades at 0.1% and derivative transactions at 0.002% -- a plan Sanders has floated in the past to pay for some of his progressive proposals. Harris would also tax offshore corporate income at the same rate as domestic corporate income.

Sanders has acknowledged that middle-class Americans would see their taxes go up under his "Medicare for All" plan, but says they'd come out ahead because they'd no longer have to pay premiums, deductibles or copays. Under the Sanders plan, households making above $29,000 would be taxed an additional premium to pay for universal health care.

No comments:

Post a Comment