Chances of a breakthrough don't seem great though, even if there may be a willingness on the part of China to do a deal.

Trump told reporters Thursday that "we're very close to doing something with China but I don't know that I want to do it" since "what we have right now is billions and billions of dollars coming into the United States in the form of tariffs or taxes."

That stance may further irritate China, and any escalation of a trade war could make life a lot more difficult for some well-known, blue chip American firms that generate a significant chunk of their sales from China.

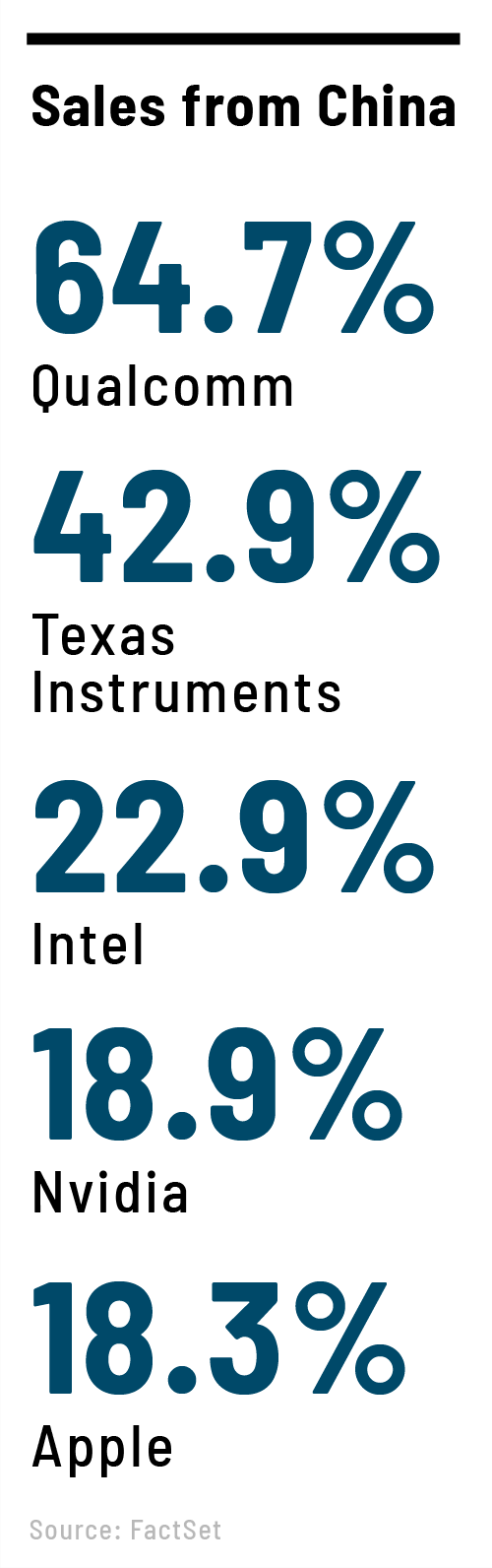

According to data compiled by FactSet, 57 companies in the S&P 500 get more than 10% of their sales from China. The list is dominated by tech giants like Qualcomm (QCOM), Texas Instruments (TXN), Nvidia (NVDA), Apple (AAPL) and Microsoft (MSFT).

Several consumer companies have made a big bet on China as well.

Tiffany (TIF), McDonald's (MCD), Starbucks (SBUX), Nike (NKE), Coach owner Tapestry (TPR) and KFC parent Yum Brands (YUM) all derived more than 10% of their latest sales from China.

And it isn't just tech and consumer products companies in the S&P 500 that could be hurt by any further escalation of trade tensions with China.

Water heater and boiler maker A.O. Smith (AOS), auto parts manufacturer Aptiv (APTV), MasterCard (MA) and Dow components Visa (V), Boeing (BA), Chevron (CVX) and 3M (MMM) all generate at least 10% of their sales from China.

Tariffs starting to take their toll on Chinese economy?

It's still not clear what the long-term impact of a protracted trade spat with China will be. But some multinational companies have started to warn that China's economy is starting to slow -- and that it is hurting US firms doing business there.

These companies could face new hurdles if the Chinese government retaliates with a further crackdown on American businesses. Chinese consumers may decide to stop buying American products too -- in China and abroad.

In fact, Tiffany just warned this week in its latest quarterly earnings report that it was being hurt by a slowdown in spending by Chinese tourists at its US and Hong Kong locations. The stock plunged on the news.

But Tiffany didn't seem to think that anti-American sentiment was the reason for tourists pulling back. In fact, the company said it has posted strong sales growth in its Asia-Pacific unit in the third quarter, led by double-digit increases in China.

"We can speculate on the reasons for the tourist spending slowdown outside of China but the reality is that the Tiffany brand is appealing to Chinese customers as evidenced by the continued strong sales growth in Mainland China in the quarter," said Tiffany CEO Alessandro Bogliolo on a conference call with analysts.

McDonald's also doesn't believe that the trade war is hurting its sales in China. Chinese consumers are still eating Big Macs and Chicken McNuggets.

"We're not really seeing any meaningful anti-American sentiment given some of the geopolitical issues that clearly exist between the countries," said McDonald's CEO Steve Easterbrook on the company's earnings call last month.

Easterbrook was talking about a recent trip he made to China and added that McDonald's is increasingly being viewed more in China as a "locally-owned business of a global brand."

But even if Chinese consumers continue to support American brands, there's another potential problem for US companies.

If, as Trump believes, the US has the upper hand in trade talks and can exert more economic pain on China with tariffs, the Chinese consumer may start to feel the pinch and buy fewer US products -- even if it's not for political reasons.

A.O. Smith CEO Kevin Wheeler said in the company's latest earnings release last month that it was already experiencing weakness in China -- and he suggested that the trade spat was one of the reasons for that.

"We believe our China sales will continue to be negatively impacted by significantly slower housing growth caused by deteriorating consumer confidence related to a weakening economy and international trade issues," Wheeler said.

No comments:

Post a Comment